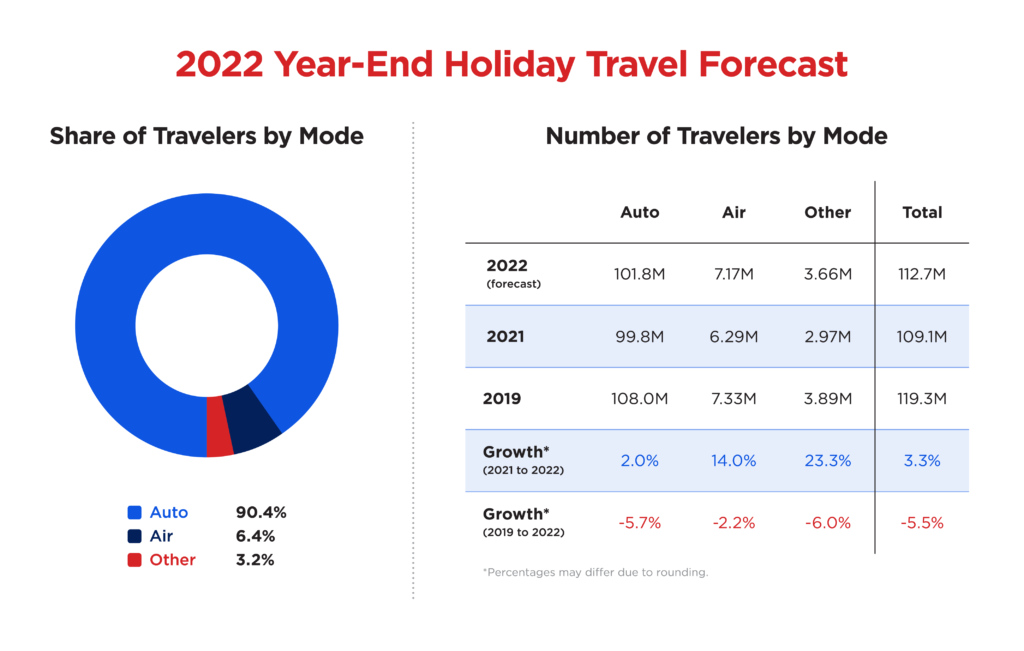

WASHINGTON, DC (December 12, 2022) – ’Tis the season to travel, and AAA estimates 112.7 million people will journey 50 miles or more away from home from December 23 to January 2. That’s an increase of 3.6 million people over last year and closing in on pre-pandemic numbers. 2022 is expected to be the third busiest year for holiday travel since AAA began tracking in 2000.

“This year, travel time will be extended due to Christmas Day and New Year’s Day falling on Sundays,” says Paula Twidale, AAA’s Senior Vice President of Travel. “With hybrid work schedules, we are seeing more people take long weekends to travel because they can work remotely at their destination and be more flexible with the days they depart and return.”

Nearly 102 million Americans will drive to their holiday destinations. Despite roller-coaster gas prices in 2022, this holiday season will see an additional 2 million drivers compared to 2021. Travel by car this year is on par with 2018 but shy of 2019 when 108 million Americans drove out of town for the holidays, the highest year on record.

Air travel will see a 14% increase over last year, with nearly 7.2 million Americans expected to fly. Flights and airports will be packed this holiday season, reminiscent of pre-pandemic days. Demand for flights has surged despite higher airline ticket prices. AAA expects the number of people taking holiday flights this year will come close to matching 2019 when 7.3 million Americans traveled by air.

“If the distance is not reasonable to drive, more people are taking to the air to maximize the time spent at their destination,” Twidale adds. “Conversely, if the travel distances are reasonable and more than one or two people in the household are taking the trip, it may be more cost-effective to drive rather than buy multiple air tickets, rent a car, and spend too much money before the fun even begins.”

Other modes of transportation are also rebounding in a big way. AAA estimates travel by bus, rail, and cruise ship will rise to 3.6 million this holiday season, a 23% increase from last year and nearly 94% of 2019’s volume.

Busiest Corridors and Best/Worst Times to Travel

Busiest Corridors and Best/Worst Times to Travel

INRIX, a provider of transportation analytics and insights, expects the most congested days on the road to be Friday before Christmas, December 27 and 28, and on Monday, January 2, as travelers mix with commuters. In major metros, especially in Los Angeles and New York City, drivers could experience double the typical delays. Nationwide, drivers could see travel times up to 25% longer.

“With pre-pandemic levels of travelers hitting the road this holiday, drivers must be prepared for delays in and around major metro areas, with Tuesday, December 27 expected to be the nation’s worst day to travel,” says Bob Pishue, transportation analyst at INRIX. “Our advice is to avoid traveling during peak commuting hours. If schedules allow, leave bright and early or after the afternoon commute.”

Best & Worst Times to Travel by Car

| Date | Worst travel time | Best travel time |

| 12/23/22 | 4:00-7:00 PM | Before 2:00 PM, After 8:00 PM |

| 12/24/22 | 12:00-6:00 PM | Before 11:00 AM, After 7:00 PM |

| 12/25/22 – Minimal Traffic Expected | ||

| 12/26/22 | 2:00-6:00 PM | Before 12:00 PM, After 7:00 PM |

| 12/27/22 | 3:00-7:00 PM | Before 2:00 PM, After 8:00 PM |

| 12/28/22 | 3:00-7:00 PM | Before 2:00 PM, After 8:00 PM |

| 12/29/22 | 3:00-7:00 PM | Before 2:00 PM, After 8:00 PM |

| 12/30/22 | 3:00-7:00 PM | Before 2:00 PM, After 8:00 PM |

| 12/31/22 – Minimal Traffic Expected | ||

| 1/1/23 – Minimal Traffic Expected | ||

| 1/2/23 | 4:00-7:00 PM | Before 3:00 PM, After 8:00 PM |

Source: INRIX

Peak Congestion by Metro

| Metro | Corridor | Peak congestion period (date/time) |

Compared to Typical |

| Atlanta | I-75 North, GA-17 to I-675 | 1/2/2023, 5:15-6:15 PM | 65% |

| Boston | I-93 South, Albany St to MA-24 | 12/28/2022, 3:00-5:00 PM | 47% |

| Chicago | I-290 East, Mannheim Rd to Paulina St | 12/27/2022, 4:45-6:45 PM | 75% |

| Detroit | I-94 West, Gratiot Ave to Michigan Ave | 1/2/2023, 12:00-2:00 PM | 27% |

| Houston | I-69 North, I-610 to TX-10 | 12/27/2022, 3:45-5:45 PM | 36% |

| Los Angeles | I-5 South, Colorado St to Florence Ave | 12/27/2022, 5:30-7:30 PM | 95% |

| New York | I-278 West, I-495 to 6th Ave | 12/27/2022, 3:45-5:45 PM | 112% |

| San Francisco | I-80 East, Maritime St to San Pablo Dam Rd | 12/28/2022, 5:00-7:00 PM | 50% |

| Seattle | I-5 South, WA-18 to WA-7 | 12/28/2022, 4:00-6:00 PM | 62% |

| Washington DC | I-95 South, MD-212 to Central Ave | 12/27/2022, 9:30-11:30 AM | 68% |

Source: INRIX

Expected Traffic by Metro & Corridor

| Metro | Corridor | Day | Increase over Typical |

| Atlanta | I-75 North, Exit 205 to Exit 227 | Monday, Jan 02, 2023 | 65% |

| I-85 South, Exit 91 to Exit 248A | Monday, Jan 02, 2023 | 65% | |

| I-85 Clockwise, Exit 29 to Exit 46 | Monday, Jan 02, 2023 | 41% | |

| I-285 Counterclockwise, Exit 27 to Exit 10B | Monday, Jan 02, 2023 | 41% | |

| US-19 North, Exit 4B to Exit 10 | Monday, Jan 02, 2023 | 25% | |

| Boston | I-93 South, Exit 20 to Exit 4 | Wednesday, Dec 28, 2022 | 47% |

| MA-3 North, Exit 15 to Exit 23 | Wednesday, Dec 28, 2022 | 42% | |

| I-93 North, Exit 23 to Exit 34 | Tuesday, Dec 27, 2022 | 32% | |

| I-95 South, Exit 20B to Exit 10 | Wednesday, Dec 28, 2022 | 17% | |

| I-90 West, Exit 20 to 11A | Wednesday, Dec 28, 2022 | 17% | |

| Chicago | I-290 East, Exit 17 to Exit 29B | Tuesday, Dec 27, 2022 | 75% |

| I-290 West, Exit 29B to Exit 16 | Saturday, Dec 24, 2022 | 56% | |

| I-94 East, Exit 68B to Exit 52B | Thursday, Dec 29, 2022 | 25% | |

| I-94 West, Exit 16 to Exit 160 | Tuesday, Dec 27, 2022 | 13% | |

| I-294 South, Exit 27B to Exit 17B | Tuesday, Dec 27, 2022 | 12% | |

| Detroit | I-94 West, Exit 219 to Exit 210 | Monday, Jan 02, 2023 | 27% |

| US-23 North, Exit 53 to Exit 60A | Friday, Dec 23, 2022 | 22% | |

| I-75 North, Exit 59 to Exit 67 | Friday, Dec 23, 2022 | 18% | |

| I-696 West, Exit 10 to Exit 1 | Monday, Jan 02, 2023 | 15% | |

| I-96 West, Exit 170 to Exit 162 | Friday, Dec 23, 2022 | 11% | |

| Houston | I-69 North, Exit 123 to Exit 132B | Tuesday, Dec 27, 2022 | 36% |

| I-10 West, Exit 795 to Exit 787 | Monday, Jan 02, 2023 | 26% | |

| I-610 East, Exit 4A to Exit 20 | Monday, Jan 02, 2023 | 25% | |

| I-45 South, Exit 51 to Exit 40B | Tuesday, Dec 27, 2022 | 23% | |

| I-69 South, Exit 136 to Exit 115A | Tuesday, Dec 27, 2022 | 17% | |

| LA | I-5 South, Exit 142 to Exit 124 | Tuesday, Dec 27, 2022 | 95% |

| I-405 South, Exit 57 to Exit 45 | Tuesday, Dec 27, 2022 | 64% | |

| I-10 East, Exit 1B to Exit 16A | Monday, Jan 02, 2023 | 57% | |

| I-405 South, Exit 50 to I5 | Tuesday, Dec 27, 2022 | 51% | |

| I-10 East, Exit 19 to Exit 38 | Tuesday, Dec 27, 2022 | 51% | |

| New York | I-278 West, Exit 35 to Exit 22 | Tuesday, Dec 27, 2022 | 112% |

| Belt Parkway East, Exit 3 to Exit 17 | Friday, Dec 23, 2022 | 66% | |

| I-495 North, Exit 13 to Exit 32 | Tuesday, Dec 27, 2022 | 51% | |

| Belt Parkway West, Exit 17 to Exit 3 | Tuesday, Dec 27, 2022 | 49% | |

| I-495 South, Exit 44 to Exit 16 | Tuesday, Dec 27, 2022 | 44% | |

| San Francisco | I-80 East, Exit 8A to Exit 18 | Wednesday, Dec 28, 2022 | 50% |

| I-80 West, Exit 13 to Exit 1A | Wednesday, Dec 28, 2022 | 48% | |

| I-580 East, Exit 34 to Exit 65 | Tuesday, Dec 27, 2022 | 37% | |

| I-680 East, Exit 8 to Exit 50 | Tuesday, Dec 27, 2022 | 22% | |

| US-101 North, Exit 439 to Exit 451 | Wednesday, Dec 28, 2022 | 21% | |

| Seattle | I-5 South, Exit 142B to Exit 133 | Wednesday, Dec 28, 2022 | 62% |

| I-405 South, Exit 18 to Exit 6 | Wednesday, Dec 28, 2022 | 38% | |

| I-5 South, Exit 182 to Exit 164 | Wednesday, Dec 28, 2022 | 37% | |

| I-5 North, Exit 168B to Exit 182 | Wednesday, Dec 28, 2022 | 27% | |

| I-405 North, Exit 2 to Exit 9 | Monday, Jan 02, 2023 | 24% | |

| Washington DC | I-95 South, Exit 170A to Exit 160 | Thursday, Dec 29, 2022 | 68% |

| I-95 South, Exit 29B to Exit 15 | Tuesday, Dec 27, 2022 | 29% | |

| I-495 Counterclockwise, Exit 27 to Exit 45 | Monday, Dec 26, 2022 | 27% | |

| I-270 East, Exit 1 to Exit 32 | Monday, Jan 02, 2023 | 16% | |

| I-95 North, Exit 170A to Exit 22A | Tuesday, Dec 27, 2022 | 14% |

Source: INRIX

Holiday Forecast Methodology: A Brief Overview

Travel Forecast

In cooperation with AAA, S&P Global Market Intelligence developed a unique methodology to forecast actual domestic travel volumes. The economic variables used to forecast travel for the current holiday are leveraged from S&P Global Market Intelligence’s proprietary databases. These data include macroeconomic drivers such as employment, output, household net worth, asset prices, including stock indices, interest rates, housing market indicators, and variables related to travel and tourism, including gasoline prices, airline travel, and hotel stays. AAA and S&P Global Market Intelligence have quantified holiday travel volumes going back to 2000.

Historical travel volume estimates come from DK SHIFFLET’s TRAVEL PERFORMANCE/Monitor SM. The PERFORMANCE/Monitor SM is a comprehensive study measuring the travel behavior of U.S. residents. DK SHIFFLET contacts over 50,000 U.S. households each month to obtain detailed travel data, resulting in the unique ability to estimate visitor volume and spending, identify trends and forecast U.S. travel behavior—all after the trips have been taken.

The travel forecast is reported in person-trips. In particular, AAA and S&P Global Market Intelligence forecast the total U.S. holiday travel volume and expected mode of transportation. The travel forecast presented in this report was prepared for the week of November 15, 2022.

Year-End Holiday Travel Period

For purposes of this forecast, the year-end holiday travel period is defined as the 11-day period from Friday, December 23 to Monday, January 2. This period is the same length as the 2021/2022 year-end travel period.

The year-end holiday travel period can range from 10 to 13 days, depending on which day of the week Christmas Day and New Year’s Day fall. All the year-end holiday periods contain two weekends.

About AAA

Started in 1902 by automotive enthusiasts who wanted to chart a path for better roads in America and advocate for safe mobility, AAA has transformed into one of North America’s largest membership organizations. Today, AAA provides roadside assistance, travel, discounts, financial and insurance services to enhance the life journey of 62 million members across North America, including 56 million in the United States. To learn more about all AAA has to offer or to become a member, visit AAA.com

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep, and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow today. For more information, visit www.spglobal.com/marketintelligence.

About DKSA

DK SHIFFLET boasts the industry’s most complete database on U.S. resident travel both in the U.S. and worldwide. Data is collected monthly from a U.S. representative sample, adding over 60,000 traveling households annually, and is used daily by leading travel organizations and their strategic planning groups. DK SHIFFLET is an MMGY Global company.

About INRIX

Founded in 2004, INRIX pioneered intelligent mobility solutions by transforming big data from connected devices and vehicles into mobility insights. This revolutionary approach enabled INRIX to become one of the leading providers of data and analytics into how people move. By empowering cities, businesses, and people with valuable insights, INRIX is helping to make the world smarter, safer, and greener. With partners and solutions spanning across the entire mobility ecosystem, INRIX is uniquely positioned at the intersection of technology and transportation – whether it’s keeping road users safe, improving traffic signal timing to reduce delay and greenhouse gasses, optimizing last-mile delivery, or helping uncover market insights. Learn more at INRIX.com.