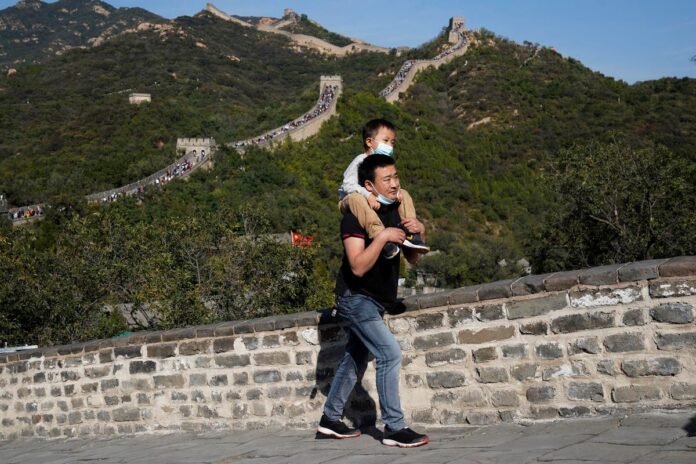

The Great Wall of China has long been a popular tourist attraction in the country. (AP Photo/Ng Han … [+]

Copyright 2020 The Associated Press. All rights reserved.

A global focus of China’s struggling economy has been its real estate industry. New data on Friday underscores problems in another sector that employs millions: tourism.

Domestic tourist trips in China, home to one of the world’s largest travel and tourism industries, plunged by more than 22% in the first half amid fallout from the country’s “zero-Covid” policies.

The number of trips declined to 1.45 billion in the first half of 2022 from 1.87 billion a year earlier, according to figures from the country’s Xinhua News Agency, citing Ministry of Culture and Tourism data.

Draconian “zero-Covid” lockdowns left tens of millions stuck at a home for weeks in the country in the second quarter in major cities including Shanghai and Beijing. The European Union Chamber last month said unpredictability in China’s response to the pandemic was “poisonous” for its business environment. China says its approach is helping to save lives.

The decline in tourist visits is a part a lackluster performance by an economy that has been a world growth leader in recent decades. Second-quarter GDP growth of only 0.4%, reported on Friday, was below the government’s target of 5.5% expansion for this year. Spending by domestic tourists declined to $173 billion in the first half of this year from $248 billion a year earlier, according to Xinhua figures.

Travel and tourism are notable for the jobs they create. Back in pre-pandemic 2019, around 28.25 million people were directly employed in the travel and tourism sector in China, according to Statista. Travel and tourism offered nearly 79.9 million jobs directly and indirectly, it says.

China’s hotel and travel stocks have been hurt. Among U.S. traded shares, H World, the large hotel chain chaired by Chinese billionaire Ji Qi, has lost 22.6% in the past year and closed down 1.1% on Friday at $38.43. Trip.com, China’s biggest online travel site, fell 0.5% and closed at $25.36 on Friday; it has lost 16% of its value in the past year during the global pandemic.

Those shares have bounced back from their 2022 lows, however, suggesting some investors think the worst may be over. H World closed at $22.28 on March 14; Trip.com ended at $16.75 that day.

See related posts:

China’s Unpredictability Is “Poisonous” For Its Business Environment — EU Chamber

China Lockdowns, Inflation Help Fuel 15% Drop In Global PC Shipments

@rflannerychina