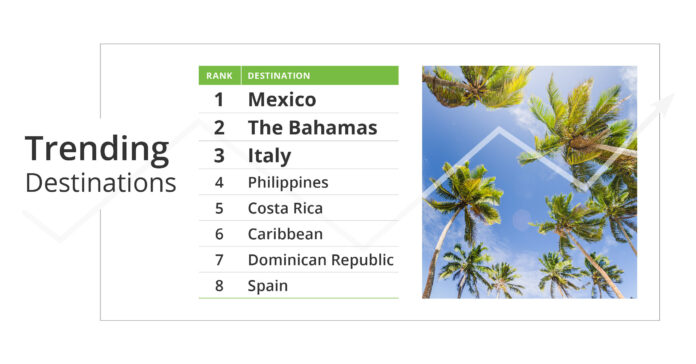

- Mexico

- The Bahamas

- Italy

- Philippines

- Costa Rica

- Caribbean

- Dominican Republic

- Spain

Source: InsureMyTrip policies sold for trips scheduled for departure between March 13, 2022 – March 27, 2022

InsureMyTrip Product Manager Meghan Walch offered responses to top questions from travelers regarding how travel insurance benefits may apply for spring break trips.

Q: What happens if you contract COVID-19 on spring break and can’t fly home?

Walch: Contracting COVID-19 can happen anywhere, even on vacation. If a spring breaker contracts the virus during a trip, and is ordered to quarantine by a physician, he or she may need to stay in a foreign country longer than expected.

If this happens, you may find coverage for quarantining under trip interruption or trip delay.

Trip Interruption may be able to help reimburse the prepaid, non-refundable trip cost for the portion of a trip missed because of a covered quarantine.

Travel Delay benefits may help to reimburse additional expenses (up to a specific limit), such as meals and accommodations related to the quarantine.

Typically for a quarantine to be covered, it must also be physician-ordered, and you are in strict isolation for a specific period of time.

Every policy is different, so it is important to understand how your travel insurance company defines “quarantine”.

NOTE: Plans will not cover self-quarantine or stay-at-home orders.

Q: What happens if you contract COVID-19 on spring break and need to seek medical attention?

Walch: Most domestic health insurance policies will not cover medical bills for emergency treatment incurred abroad. So, if you are concerned about seeking emergency medical attention, while traveling out of the country, I would recommend a policy that includes emergency medical coverage.

Emergency medical coverage can be part of a comprehensive policy or purchased as a standalone Travel Medical plan. This coverage can offer reimbursement for unexpected/covered emergency medical expenses.

Having a travel medical plan that includes emergency evacuation may offer coverage for the cost of transport to the nearest appropriate medical care facility if deemed necessary by the initial treating physician.

MORE: Travel Insurance & COVID-19

Q: What if you want to get back out of a spring break trip because of fear of contracting COVID-19?

Walch: Many countries are relaxing COVID-19 requirements and restrictions. However, the most popular spring break destinations are on the Centers for Disease Control (CDC) Level 4 Travel Health Notice (THN) list.

For this reason, I would recommend spring breakers purchase a travel insurance policy with the added “Cancel for Any Reason” (CFAR) benefit.

CFAR offers the most flexibility for spring breakers to cancel a trip because they are afraid to travel.

This benefit is time-sensitive and there are some eligibility requirements, but if those are met, reimbursement can be up to 50% – 75% of the insured, pre-paid, nonrefundable trip costs if the trip is canceled at least two (2) days prior to departure.

MORE: Cancel for Any Reason Information

Q: Are there travel insurance exclusions of which spring breakers should be aware?

Walch: Drinking alcohol and participating in adventure sports are often part of a spring break vacation. However, it is important to know what your travel insurance policy covers and does not cover if an injury occurs while participating in one of these activities.

Policies will also exclude coverage for issues that arise while a traveler is intoxicated. So, if you need to seek medical attention for an alcohol-related injury – like alcohol poisoning or falling while drinking – you will likely not find coverage through your travel insurance policy.

If you plan on booking an adventure or sports-based excursion, it is important to note that some policies will not cover extreme activities. So, I always advise travelers to check their policy to understand the exclusions and contact your travel insurance agent if you are not sure.

MORE: Extreme Sports & Adventure Travel Insurance Information

Reporters can request an interview or quote from Travel Insurance Expert Meghan Walch by contacting [email protected].

Media Contact:

Meghan Kayata

[email protected]

About InsureMyTrip

It’s simple. InsureMyTrip finds you the right travel insurance plan, every time. InsureMyTrip is the authority on travel insurance. We are committed to empowering travelers to make the best possible insurance decisions by leveraging our technology, data intelligence, and expertise. InsureMyTrip is rated A+ by the Better Business Bureau.

Note: coverages are governed by the specific plan certificate. Traditional travel insurance does not offer cancellation coverage for fear of travel, whether related to COVID-19 or not. Cancel For Any Reason is required.

SOURCE InsureMyTrip

Unlock the world’s wonders with unforgettable journeys tailored just for you! Whether you crave sun-kissed beaches, thrilling adventures, or rich cultural escapes, your dream destination awaits. Enjoy seamless travel with expert tips, exclusive deals, and handpicked experiences that Turn Every Trip into a lifetime memory.